-

In September, we learned that consumer prices in the UK rose by 2.2% in the 12 months to August –...

In September, we learned that consumer prices in the UK rose by 2.2% in the 12 months to August –... -

Emerging markets experienced a remarkable surge in September, climbing over 7% in dollar terms, marking their strongest month since November...

Emerging markets experienced a remarkable surge in September, climbing over 7% in dollar terms, marking their strongest month since November... -

In August, we learned that consumer prices in the UK rose by 2.2% in the 12 months to July –...

In August, we learned that consumer prices in the UK rose by 2.2% in the 12 months to July –... -

In March 2024, the FCA concluded a thematic review (TR24/1) into retirement income advice. Interestingly, within this review, they found that...

In March 2024, the FCA concluded a thematic review (TR24/1) into retirement income advice. Interestingly, within this review, they found that... -

In July, we learned that consumer prices in the UK rose by 2.0% in the 12 months to June –...

In July, we learned that consumer prices in the UK rose by 2.0% in the 12 months to June –... -

You will have likely woken up to the news that global stock markets have fallen sharply. This appears to be because...

You will have likely woken up to the news that global stock markets have fallen sharply. This appears to be because... -

You will have seen that the Bank of England (BoE) cut interest rates by 0.25% today, the first cut since...

You will have seen that the Bank of England (BoE) cut interest rates by 0.25% today, the first cut since... -

The world of politics took a surprising turn over the weekend, as we learnt that US President Joe Biden has...

The world of politics took a surprising turn over the weekend, as we learnt that US President Joe Biden has... -

It is conventional wisdom that investment decisions are usually informed by an assessment of the investor’s willingness to take risk...

It is conventional wisdom that investment decisions are usually informed by an assessment of the investor’s willingness to take risk... -

In June, we learned that consumer prices in the UK rose by 2.0% in the 12 months to May 2024,...

In June, we learned that consumer prices in the UK rose by 2.0% in the 12 months to May 2024,... -

Following the overnight news that Keir Starmer and the Labour Party won a large majority in the UK General Election,...

Following the overnight news that Keir Starmer and the Labour Party won a large majority in the UK General Election,... -

As one may suspect, we are often among the first companies called by an investment business when a fund manager...

As one may suspect, we are often among the first companies called by an investment business when a fund manager... -

In May, we learned that consumer prices in the UK rose by 2.3% in the 12 months to April 2024,...

In May, we learned that consumer prices in the UK rose by 2.3% in the 12 months to April 2024,... -

Yesterday, it was announced that the UK will hold a general election on July 4th 2024. We can understand how...

Yesterday, it was announced that the UK will hold a general election on July 4th 2024. We can understand how... -

The conscious decision to invest in one asset class over another is probably the most important investment decision we will...

The conscious decision to invest in one asset class over another is probably the most important investment decision we will... -

In April, we learned that consumer prices in the UK rose by 3.2% in the 12 months to March 2024,...

In April, we learned that consumer prices in the UK rose by 3.2% in the 12 months to March 2024,... -

You will have likely seen the news on Saturday. On the back of these developments, we noted that equities in...

You will have likely seen the news on Saturday. On the back of these developments, we noted that equities in... -

In March, we learned that consumer prices in the UK had risen by 3.4% in the 12 months to February...

In March, we learned that consumer prices in the UK had risen by 3.4% in the 12 months to February... -

February saw diverging fortunes in markets, with stocks performing well while fixed income markets were largely down. Within fixed income, it...

February saw diverging fortunes in markets, with stocks performing well while fixed income markets were largely down. Within fixed income, it... -

Chancellor Hunt unveiled this year’s Budget on Wednesday in the House of Commons. Background Since the next UK general election is likely...

Chancellor Hunt unveiled this year’s Budget on Wednesday in the House of Commons. Background Since the next UK general election is likely... -

One of the most common questions we receive from our clients revolves is whether to remain in cash or transition...

One of the most common questions we receive from our clients revolves is whether to remain in cash or transition... -

The “Magnificent Seven” Stocks - Our View and Portfolio Exposure – Fundhouse Adviser Insights6th March 2024The concentration in the S&P 500 of just seven names – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla is...

The “Magnificent Seven” Stocks - Our View and Portfolio Exposure – Fundhouse Adviser Insights6th March 2024The concentration in the S&P 500 of just seven names – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla is... -

In December, the annual level of UK Consumer Price Inflation rose to 4%, up from 3.9% in November (with a...

In December, the annual level of UK Consumer Price Inflation rose to 4%, up from 3.9% in November (with a... -

In November, the annual level of UK Consumer Price Inflation fell to 3.9%, down from 4.6% in October. It is...

In November, the annual level of UK Consumer Price Inflation fell to 3.9%, down from 4.6% in October. It is... -

November saw positive news on inflation – UK CPI data for October fell to 4.6%, a notable drop from 6.7%...

November saw positive news on inflation – UK CPI data for October fell to 4.6%, a notable drop from 6.7%... -

On Tuesday, the FCA released a 212-page Policy Statement on Sustainability Disclosure Requirements (SDR) & Investment Labels. These new rules will...

On Tuesday, the FCA released a 212-page Policy Statement on Sustainability Disclosure Requirements (SDR) & Investment Labels. These new rules will... -

On Wednesday, Chancellor Hunt delivered an ‘Autumn Statement’ to give Parliament an economic update and announce new policies – “110...

On Wednesday, Chancellor Hunt delivered an ‘Autumn Statement’ to give Parliament an economic update and announce new policies – “110... -

Having seen painful double-digit inflation in late 2022, it was something of a relief in October to see UK inflation...

Having seen painful double-digit inflation in late 2022, it was something of a relief in October to see UK inflation... -

At Fundhouse (UK), we help our clients avoid pitfalls when choosing funds. Fundhouse CIO Joe Wiggins investigates why following the...

At Fundhouse (UK), we help our clients avoid pitfalls when choosing funds. Fundhouse CIO Joe Wiggins investigates why following the... -

At Fundhouse, we dig deeper into the data to make better investment decisions for our clients. Have UK equity fund managers...

At Fundhouse, we dig deeper into the data to make better investment decisions for our clients. Have UK equity fund managers... -

2022 has been an incredibly difficult year for investors. Not only have we seen steep declines in equity markets, but...

2022 has been an incredibly difficult year for investors. Not only have we seen steep declines in equity markets, but... -

As a UK citizen, it is certainly worrying that we have our fourth Chancellor and (soon to be) third prime...

As a UK citizen, it is certainly worrying that we have our fourth Chancellor and (soon to be) third prime... -

The UK commercial property market is facing a torrid environment. Not only is the economic outlook bleak; but rising interest...

The UK commercial property market is facing a torrid environment. Not only is the economic outlook bleak; but rising interest... -

Over the years at Fundhouse (UK), we’ve spoken to dozens of #assetmanagement firms undergoing corporate change. Today, we share insights on...

Over the years at Fundhouse (UK), we’ve spoken to dozens of #assetmanagement firms undergoing corporate change. Today, we share insights on... -

Based on years of observation and bitter, painful experience; here are my thoughts on the ten most significant mistakes made...

Based on years of observation and bitter, painful experience; here are my thoughts on the ten most significant mistakes made... -

At Fundhouse (UK), we use our own algorithms to analyse trading patterns, giving our clients greater #investmentclarity about the funds...

At Fundhouse (UK), we use our own algorithms to analyse trading patterns, giving our clients greater #investmentclarity about the funds... -

At Fundhouse (UK), we monitor the fund universe for signs of #liquidity issues, to give our clients better #InvestmentClarity. Today, we...

At Fundhouse (UK), we monitor the fund universe for signs of #liquidity issues, to give our clients better #InvestmentClarity. Today, we... -

At Fundhouse (UK) we’ve been building a #greenwashing detector to give our clients greater #investmentclarity. We’ve uncovered a number of insights...

At Fundhouse (UK) we’ve been building a #greenwashing detector to give our clients greater #investmentclarity. We’ve uncovered a number of insights... -

In today’s blog, we look back at the many meetings that we have had with fund groups discussing ESG. Although...

In today’s blog, we look back at the many meetings that we have had with fund groups discussing ESG. Although... -

As part of our manager research process for a given fund, we will evaluate the corporate entity employing the investment...

As part of our manager research process for a given fund, we will evaluate the corporate entity employing the investment... -

In this article, we explore whether there is persistency in tactical asset allocation skill, by evaluating the evidence we have...

In this article, we explore whether there is persistency in tactical asset allocation skill, by evaluating the evidence we have... -

In this article, we discuss how the historic low yields we are seeing in credit markets today does not seem...

In this article, we discuss how the historic low yields we are seeing in credit markets today does not seem...

The Asset Allocator’s Dilemma: November 2021

|

Home » Published: 16th November 2021 This Article was Written by: Rory Maguire - Fundhouse |

As we conclude our client quarterly investment committees, we are struck by how odd the market has become.

Over many years now, we have seen the market invert past norms and this has significant and unique consequences for how you build a portfolio for a bear market.

Where we are today

There is no hiding that we are nervous of markets. For the first time we can remember, prices are exceptionally high across most asset classes at the same time. US house prices are at record highs (as a percentage of household income), bond yields are at unprecedented lows, commodities ex energy (S&P GSCI Non Energy) are back to the peaks of 10 years ago at the top of the super cycle and US equities are at extreme highs. We find no precedent for this, where all major asset classes are expensive together. Take two recent equity market peaks, 2000 and 2007. Back in 2000, REITS paid out dividends of over 8% (inflation was under 2%) and Gilts offered a real yield of around 3%. And in 2008, Gilts and corporate bonds also offered very healthy real yields. Today pretty much all mainstream income producing investments run at substantial negative real yields. Being defensive seems rational.

How do you build a defensive portfolio?

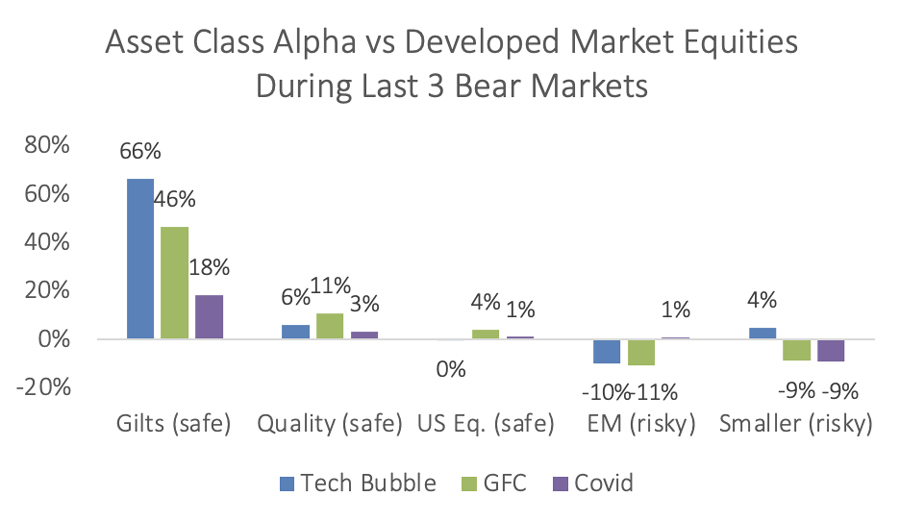

The behaviour of asset classes during past bear markets would usually be instructive. Below we show a chart that reflects the excess returns of ‘safe’ and ‘risky’ assets during 3 recent stock market sell offs. As you may expect, history suggests that ‘safe’ assets are sensible and ‘risky’ assets aren’t:

- Government bonds have been the ultimate safe haven.

- From an equity style perspective, defensive, high quality equities have offered better downside protection.

- US equities usually outperform other regions, as investors seek the safety of the world’s biggest equity market.

- Emerging markets have sold off more than developed, as investors flee the ‘risky’ developing markets.

- Small caps lose more than mega caps, on average, because they are seen as riskier.

Is history a sensible guide for today? When we reflect on the patterns we see in the current data, it inverts many historic norms: in a strongly rising market across almost all asset classes, we find expensive has beaten cheap, large (mega cap) has beaten small, developed has beaten emerging and defensive has beaten cyclical. Does this suggest an equally unique approach to defensive asset allocation may be called for? If so, it poses a real dilemma.

The dilemma

For the first time, the family of ‘safe’ assets are expensive. The dilemma is this: if you are bearish, you can follow history and own overpriced ‘safe’ assets because of how they behaved during prior down markets. Or build a portfolio that favours cheap (historically ‘riskier’) over expensive: avoiding bonds, high quality equities and mega caps, while favouring emerging markets and cyclical equities. On paper, that is a bull market portfolio, built by a bear. Is it time to totally bet against history? If you look at valuations, probably.

Fundhouse provides manager research and asset allocation services to institutions. Within these one-pagers, we discuss our findings into both manager research and asset allocation. To subscribe to these one-pagers, please sign-up here. Professional investors only please.