-

The world of politics took a surprising turn over the weekend, as we learnt that US President Joe Biden has...

The world of politics took a surprising turn over the weekend, as we learnt that US President Joe Biden has... -

It is conventional wisdom that investment decisions are usually informed by an assessment of the investor’s willingness to take risk...

It is conventional wisdom that investment decisions are usually informed by an assessment of the investor’s willingness to take risk... -

In June, we learned that consumer prices in the UK rose by 2.0% in the 12 months to May 2024,...

In June, we learned that consumer prices in the UK rose by 2.0% in the 12 months to May 2024,... -

Following the overnight news that Keir Starmer and the Labour Party won a large majority in the UK General Election,...

Following the overnight news that Keir Starmer and the Labour Party won a large majority in the UK General Election,... -

As one may suspect, we are often among the first companies called by an investment business when a fund manager...

As one may suspect, we are often among the first companies called by an investment business when a fund manager... -

In May, we learned that consumer prices in the UK rose by 2.3% in the 12 months to April 2024,...

In May, we learned that consumer prices in the UK rose by 2.3% in the 12 months to April 2024,... -

Yesterday, it was announced that the UK will hold a general election on July 4th 2024. We can understand how...

Yesterday, it was announced that the UK will hold a general election on July 4th 2024. We can understand how... -

The conscious decision to invest in one asset class over another is probably the most important investment decision we will...

The conscious decision to invest in one asset class over another is probably the most important investment decision we will... -

In April, we learned that consumer prices in the UK rose by 3.2% in the 12 months to March 2024,...

In April, we learned that consumer prices in the UK rose by 3.2% in the 12 months to March 2024,... -

You will have likely seen the news on Saturday. On the back of these developments, we noted that equities in...

You will have likely seen the news on Saturday. On the back of these developments, we noted that equities in... -

In March, we learned that consumer prices in the UK had risen by 3.4% in the 12 months to February...

In March, we learned that consumer prices in the UK had risen by 3.4% in the 12 months to February... -

February saw diverging fortunes in markets, with stocks performing well while fixed income markets were largely down. Within fixed income, it...

February saw diverging fortunes in markets, with stocks performing well while fixed income markets were largely down. Within fixed income, it... -

Chancellor Hunt unveiled this year’s Budget on Wednesday in the House of Commons. Background Since the next UK general election is likely...

Chancellor Hunt unveiled this year’s Budget on Wednesday in the House of Commons. Background Since the next UK general election is likely... -

One of the most common questions we receive from our clients revolves is whether to remain in cash or transition...

One of the most common questions we receive from our clients revolves is whether to remain in cash or transition... -

The “Magnificent Seven” Stocks - Our View and Portfolio Exposure – Fundhouse Adviser Insights6th March 2024The concentration in the S&P 500 of just seven names – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla is...

The “Magnificent Seven” Stocks - Our View and Portfolio Exposure – Fundhouse Adviser Insights6th March 2024The concentration in the S&P 500 of just seven names – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla is... -

In December, the annual level of UK Consumer Price Inflation rose to 4%, up from 3.9% in November (with a...

In December, the annual level of UK Consumer Price Inflation rose to 4%, up from 3.9% in November (with a... -

In November, the annual level of UK Consumer Price Inflation fell to 3.9%, down from 4.6% in October. It is...

In November, the annual level of UK Consumer Price Inflation fell to 3.9%, down from 4.6% in October. It is... -

November saw positive news on inflation – UK CPI data for October fell to 4.6%, a notable drop from 6.7%...

November saw positive news on inflation – UK CPI data for October fell to 4.6%, a notable drop from 6.7%... -

On Tuesday, the FCA released a 212-page Policy Statement on Sustainability Disclosure Requirements (SDR) & Investment Labels. These new rules will...

On Tuesday, the FCA released a 212-page Policy Statement on Sustainability Disclosure Requirements (SDR) & Investment Labels. These new rules will... -

On Wednesday, Chancellor Hunt delivered an ‘Autumn Statement’ to give Parliament an economic update and announce new policies – “110...

On Wednesday, Chancellor Hunt delivered an ‘Autumn Statement’ to give Parliament an economic update and announce new policies – “110... -

Having seen painful double-digit inflation in late 2022, it was something of a relief in October to see UK inflation...

Having seen painful double-digit inflation in late 2022, it was something of a relief in October to see UK inflation... -

At Fundhouse (UK), we help our clients avoid pitfalls when choosing funds. Fundhouse CIO Joe Wiggins investigates why following the...

At Fundhouse (UK), we help our clients avoid pitfalls when choosing funds. Fundhouse CIO Joe Wiggins investigates why following the... -

At Fundhouse, we dig deeper into the data to make better investment decisions for our clients. Have UK equity fund managers...

At Fundhouse, we dig deeper into the data to make better investment decisions for our clients. Have UK equity fund managers... -

2022 has been an incredibly difficult year for investors. Not only have we seen steep declines in equity markets, but...

2022 has been an incredibly difficult year for investors. Not only have we seen steep declines in equity markets, but... -

The UK commercial property market is facing a torrid environment. Not only is the economic outlook bleak; but rising interest...

The UK commercial property market is facing a torrid environment. Not only is the economic outlook bleak; but rising interest... -

Over the years at Fundhouse (UK), we’ve spoken to dozens of #assetmanagement firms undergoing corporate change. Today, we share insights on...

Over the years at Fundhouse (UK), we’ve spoken to dozens of #assetmanagement firms undergoing corporate change. Today, we share insights on... -

Based on years of observation and bitter, painful experience; here are my thoughts on the ten most significant mistakes made...

Based on years of observation and bitter, painful experience; here are my thoughts on the ten most significant mistakes made... -

At Fundhouse (UK), we use our own algorithms to analyse trading patterns, giving our clients greater #investmentclarity about the funds...

At Fundhouse (UK), we use our own algorithms to analyse trading patterns, giving our clients greater #investmentclarity about the funds... -

At Fundhouse (UK), we monitor the fund universe for signs of #liquidity issues, to give our clients better #InvestmentClarity. Today, we...

At Fundhouse (UK), we monitor the fund universe for signs of #liquidity issues, to give our clients better #InvestmentClarity. Today, we... -

At Fundhouse (UK) we’ve been building a #greenwashing detector to give our clients greater #investmentclarity. We’ve uncovered a number of insights...

At Fundhouse (UK) we’ve been building a #greenwashing detector to give our clients greater #investmentclarity. We’ve uncovered a number of insights... -

In today’s blog, we look back at the many meetings that we have had with fund groups discussing ESG. Although...

In today’s blog, we look back at the many meetings that we have had with fund groups discussing ESG. Although... -

The market has become counterintuitive: in a strongly rising market across almost all asset classes, we find expensive has beaten...

The market has become counterintuitive: in a strongly rising market across almost all asset classes, we find expensive has beaten... -

As part of our manager research process for a given fund, we will evaluate the corporate entity employing the investment...

As part of our manager research process for a given fund, we will evaluate the corporate entity employing the investment... -

In this article, we explore whether there is persistency in tactical asset allocation skill, by evaluating the evidence we have...

In this article, we explore whether there is persistency in tactical asset allocation skill, by evaluating the evidence we have... -

In this article, we discuss how the historic low yields we are seeing in credit markets today does not seem...

In this article, we discuss how the historic low yields we are seeing in credit markets today does not seem...

Do UK Prime Ministers Impact Markets?

|

Home » Published: 24th October 2022 This Article was Written by: Rory Maguire - Fundhouse |

As a UK citizen, it is certainly worrying that we have our fourth Chancellor and (soon to be) third prime minister in three months. These are unsettling times for us all and these themes are dominating news headlines.

We are reminded of two quotes during times like this. The first is from Steven Pinker, renowned Harvard psychologist and linguist: “Journalism is a non-random sample of the worst things that are happening on earth at any given time. When you look at the world through the lens of data, rather than events, it looks much more positive. 1” And Elon Musk, CEO of SpaceX and Tesla acknowledges that world leaders have limited influence, saying: “You’re actually like the captain of a very huge ship and have a small rudder. 2”

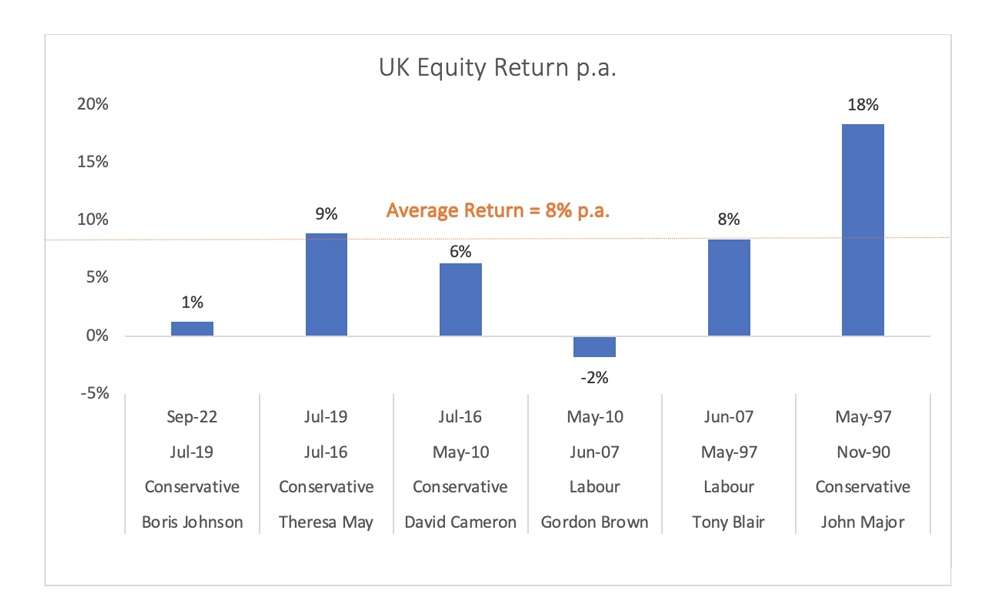

We have taken a leaf out of Pinker’s book and gone back to 1990 and assessed how UK equity markets have done during the leadership of various UK prime ministers. Below we show the returns of UK equities during the tenure of each UK prime minister since 1990 (the prime minister, their party and their tenure are shown below the graphs):

Source: Fundhouse and Refinitiv, data to end September 2022, annualised

If you were to cast your mind back to the significant geopolitical events that occurred during each tenure, the returns above may come as something of a surprise. For example, in the subsequent uncertainty of the Brexit vote and negotiations, returns during Theresa May’s leadership were a lot better than David Cameron’s, who presided over a period of economic recovery and relative stability. Additionally, markets did well during Tony Blair’s premiership, when we were in the thick of the wars in Iraq and Afghanistan. Finally, John Major did especially well considering the country was in a major recession in the early 90s and inflation hit 11% by the middle of the decade.

Yet, when we look past the prime minister and rely on data to inform our views, we can reflect on what we see as the drivers of returns over these periods:

- John Major: the 90s saw extreme increases in markets, driven largely by what would later become known as the “Tech Bubble”. And when we have high inflation, as the 90s had, corporate revenues and earnings go up by a commensurate amount and this causes markets to go up at higher rates.

- Tony Blair: he presided over the late stage of the Tech Bubble that saw boom and bust in markets. But the main driver was his tenure: he lasted 10 years, a full market cycle and 8% is about par for a full cycle.

- Gordon Brown: he presided over the Global Financial Crisis and did not have a long enough tenure to achieve long-term average returns.

- David Cameron and Theresa May: together they were leading the country over a full cycle and their returns, between 6% and 9% were close to long-term averages.

- Boris Johnson: the biggest impact was Covid and then the impact of high inflation, driven in large part by the War in Ukraine. But most importantly, his tenure was brief and over the short-term, long-term averages are very unlikely to be achieved.

As you can see, over the longer-term, the factors that drove markets had relatively little to do with who was prime minister. Both Pinker and Musk were right: the headlines tend to create fear and the actual data is quite different to what our expected experience is. Over the long-term, markets deliver returns that are close to their long-term averages, often regardless of what is happening in the outside world. And, by and large, governments have little if any ability to make meaningful change. Their rudder is small and markets end up doing what they do best: over the short term, we see extremes (Tech Bubbles, Global Financial Crises, Covid), but over full cycles returns are pretty normal and indifferent to who the prime minister is.

1 Said to the Financial Times, 24 October 2022.

2 Interview with Freshdialogues.com February 11, 2013.