-

The world of politics took a surprising turn over the weekend, as we learnt that US President Joe Biden has...

The world of politics took a surprising turn over the weekend, as we learnt that US President Joe Biden has... -

It is conventional wisdom that investment decisions are usually informed by an assessment of the investor’s willingness to take risk...

It is conventional wisdom that investment decisions are usually informed by an assessment of the investor’s willingness to take risk... -

In June, we learned that consumer prices in the UK rose by 2.0% in the 12 months to May 2024,...

In June, we learned that consumer prices in the UK rose by 2.0% in the 12 months to May 2024,... -

Following the overnight news that Keir Starmer and the Labour Party won a large majority in the UK General Election,...

Following the overnight news that Keir Starmer and the Labour Party won a large majority in the UK General Election,... -

As one may suspect, we are often among the first companies called by an investment business when a fund manager...

As one may suspect, we are often among the first companies called by an investment business when a fund manager... -

In May, we learned that consumer prices in the UK rose by 2.3% in the 12 months to April 2024,...

In May, we learned that consumer prices in the UK rose by 2.3% in the 12 months to April 2024,... -

Yesterday, it was announced that the UK will hold a general election on July 4th 2024. We can understand how...

Yesterday, it was announced that the UK will hold a general election on July 4th 2024. We can understand how... -

The conscious decision to invest in one asset class over another is probably the most important investment decision we will...

The conscious decision to invest in one asset class over another is probably the most important investment decision we will... -

In April, we learned that consumer prices in the UK rose by 3.2% in the 12 months to March 2024,...

In April, we learned that consumer prices in the UK rose by 3.2% in the 12 months to March 2024,... -

You will have likely seen the news on Saturday. On the back of these developments, we noted that equities in...

You will have likely seen the news on Saturday. On the back of these developments, we noted that equities in... -

In March, we learned that consumer prices in the UK had risen by 3.4% in the 12 months to February...

In March, we learned that consumer prices in the UK had risen by 3.4% in the 12 months to February... -

February saw diverging fortunes in markets, with stocks performing well while fixed income markets were largely down. Within fixed income, it...

February saw diverging fortunes in markets, with stocks performing well while fixed income markets were largely down. Within fixed income, it... -

Chancellor Hunt unveiled this year’s Budget on Wednesday in the House of Commons. Background Since the next UK general election is likely...

Chancellor Hunt unveiled this year’s Budget on Wednesday in the House of Commons. Background Since the next UK general election is likely... -

One of the most common questions we receive from our clients revolves is whether to remain in cash or transition...

One of the most common questions we receive from our clients revolves is whether to remain in cash or transition... -

The “Magnificent Seven” Stocks - Our View and Portfolio Exposure – Fundhouse Adviser Insights6th March 2024The concentration in the S&P 500 of just seven names – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla is...

The “Magnificent Seven” Stocks - Our View and Portfolio Exposure – Fundhouse Adviser Insights6th March 2024The concentration in the S&P 500 of just seven names – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla is... -

In December, the annual level of UK Consumer Price Inflation rose to 4%, up from 3.9% in November (with a...

In December, the annual level of UK Consumer Price Inflation rose to 4%, up from 3.9% in November (with a... -

In November, the annual level of UK Consumer Price Inflation fell to 3.9%, down from 4.6% in October. It is...

In November, the annual level of UK Consumer Price Inflation fell to 3.9%, down from 4.6% in October. It is... -

November saw positive news on inflation – UK CPI data for October fell to 4.6%, a notable drop from 6.7%...

November saw positive news on inflation – UK CPI data for October fell to 4.6%, a notable drop from 6.7%... -

On Tuesday, the FCA released a 212-page Policy Statement on Sustainability Disclosure Requirements (SDR) & Investment Labels. These new rules will...

On Tuesday, the FCA released a 212-page Policy Statement on Sustainability Disclosure Requirements (SDR) & Investment Labels. These new rules will... -

On Wednesday, Chancellor Hunt delivered an ‘Autumn Statement’ to give Parliament an economic update and announce new policies – “110...

On Wednesday, Chancellor Hunt delivered an ‘Autumn Statement’ to give Parliament an economic update and announce new policies – “110... -

Having seen painful double-digit inflation in late 2022, it was something of a relief in October to see UK inflation...

Having seen painful double-digit inflation in late 2022, it was something of a relief in October to see UK inflation... -

At Fundhouse (UK), we help our clients avoid pitfalls when choosing funds. Fundhouse CIO Joe Wiggins investigates why following the...

At Fundhouse (UK), we help our clients avoid pitfalls when choosing funds. Fundhouse CIO Joe Wiggins investigates why following the... -

At Fundhouse, we dig deeper into the data to make better investment decisions for our clients. Have UK equity fund managers...

At Fundhouse, we dig deeper into the data to make better investment decisions for our clients. Have UK equity fund managers... -

2022 has been an incredibly difficult year for investors. Not only have we seen steep declines in equity markets, but...

2022 has been an incredibly difficult year for investors. Not only have we seen steep declines in equity markets, but... -

As a UK citizen, it is certainly worrying that we have our fourth Chancellor and (soon to be) third prime...

As a UK citizen, it is certainly worrying that we have our fourth Chancellor and (soon to be) third prime... -

The UK commercial property market is facing a torrid environment. Not only is the economic outlook bleak; but rising interest...

The UK commercial property market is facing a torrid environment. Not only is the economic outlook bleak; but rising interest... -

Over the years at Fundhouse (UK), we’ve spoken to dozens of #assetmanagement firms undergoing corporate change. Today, we share insights on...

Over the years at Fundhouse (UK), we’ve spoken to dozens of #assetmanagement firms undergoing corporate change. Today, we share insights on... -

Based on years of observation and bitter, painful experience; here are my thoughts on the ten most significant mistakes made...

Based on years of observation and bitter, painful experience; here are my thoughts on the ten most significant mistakes made... -

At Fundhouse (UK), we use our own algorithms to analyse trading patterns, giving our clients greater #investmentclarity about the funds...

At Fundhouse (UK), we use our own algorithms to analyse trading patterns, giving our clients greater #investmentclarity about the funds... -

At Fundhouse (UK), we monitor the fund universe for signs of #liquidity issues, to give our clients better #InvestmentClarity. Today, we...

At Fundhouse (UK), we monitor the fund universe for signs of #liquidity issues, to give our clients better #InvestmentClarity. Today, we... -

At Fundhouse (UK) we’ve been building a #greenwashing detector to give our clients greater #investmentclarity. We’ve uncovered a number of insights...

At Fundhouse (UK) we’ve been building a #greenwashing detector to give our clients greater #investmentclarity. We’ve uncovered a number of insights... -

In today’s blog, we look back at the many meetings that we have had with fund groups discussing ESG. Although...

In today’s blog, we look back at the many meetings that we have had with fund groups discussing ESG. Although... -

The market has become counterintuitive: in a strongly rising market across almost all asset classes, we find expensive has beaten...

The market has become counterintuitive: in a strongly rising market across almost all asset classes, we find expensive has beaten... -

In this article, we explore whether there is persistency in tactical asset allocation skill, by evaluating the evidence we have...

In this article, we explore whether there is persistency in tactical asset allocation skill, by evaluating the evidence we have... -

In this article, we discuss how the historic low yields we are seeing in credit markets today does not seem...

In this article, we discuss how the historic low yields we are seeing in credit markets today does not seem...

Increased fund manager M&A

|

Home » Published: 8th July 2021 This Article was Written by: Rory Maguire - Fundhouse |

As part of our manager research process for a given fund, we will evaluate the corporate entity employing the investment team.

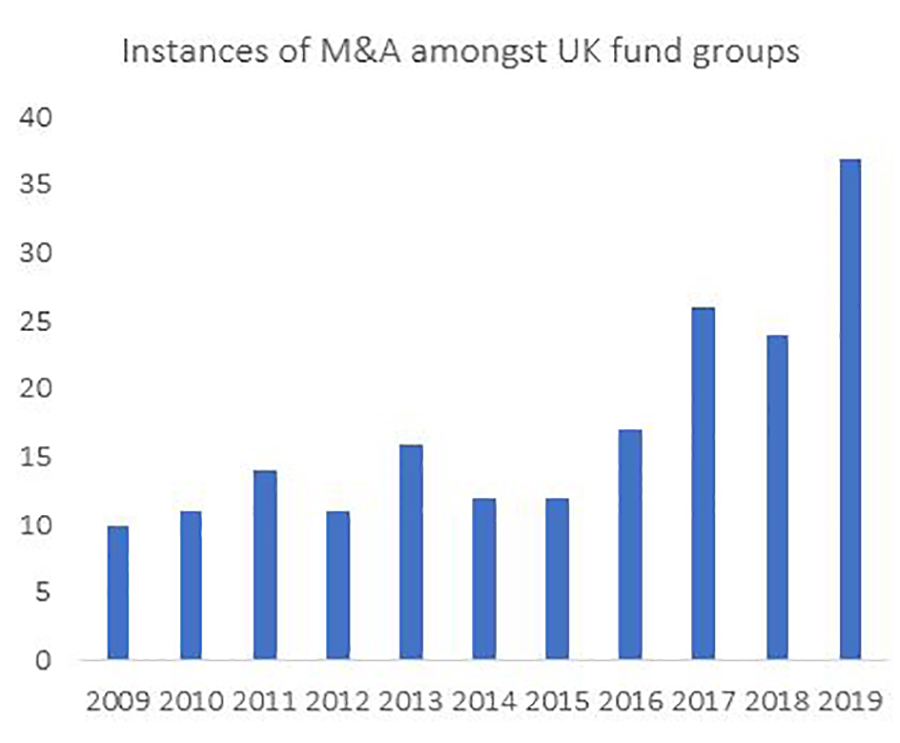

Over the last five years, our team has had to focus more and more attention on fund groups that are merging with and/or acquiring other firms. What does our data show?

Looking at the numbers

Fund groups have been partaking in M&A for two broad reasons. The first is to achieve better scale and product diversification within the newly created and larger combined entity. Examples include Columbia Threadneedle (and the more recently announced acquisition of BMO’s EMEA investment business), Janus Henderson, Aberdeen Standard (now ‘abrdn’), BlackRock/BGI and Jupiter Merian. The second is to become closer to the client by entering distribution. Examples would be M&G’s purchasing Ascentric, Schroders purchasing Cazenove and Benchmark Capital, Invesco purchasing Intelliflo, BNP’s stake in Allfunds, and Franklin Templeton’s stake in Embark, among others. Looking back over the 10 years to 2019, we see a large increase in fund group M&A, as shown in the graph (source: Fundhouse and The Investment Association).

What are our findings?

Although individual examples may differ, when assimilating the data on M&A, in aggregate it throws out some very interesting observations and we discuss these general points below.

- Communication becomes vague and erratic for extended periods: Details around the impact of the deal are almost always unclear and large changes (e.g., team mergers and changes to executives) tend to be announced without warning, which is unsettling for clients and the investment teams within the fund groups.

- Change is almost guaranteed: We usually observe significant change, whether it be to executive leadership, investment and client teams, location, products, incentives, or operational infrastructure.

- It becomes all-consuming, particularly the bigger deals: We find that the executives focus much of their attention on the deal and the post-deal integration, rather than the existing business.

- Often new CEOs are appointed, bringing second rounds of change: Examples include Stephen Bird at abrdn and Richard Weil at Janus Henderson bringing their own changes to the table following the merger.

- Staff depart more frequently, and firms are no longer employers of choice: For years after the deal, we find higher investment staff turnover on average and new joiners are not always of equivalent experience.

- Clients experience change in servicing, products and fund managers: This is the key point. We often find that clients are understanding and take a pragmatic view on M&A within the fund groups they support. But so frequently there is more change than expected and clients eventually lose patience. We have also seen numerous examples of combined AUM post-merger being lower than pre-merger (of the individual entities).

- Not all M&A is negative: We appreciate that not all M&A is negative and that a change in ownership can improve matters, like reducing key person risk, enabling ownership succession and diversifying revenue. Although our data suggests that such deals are rare (around 1 in 10), these positive examples do exist.

Fundhouse provides manager research and asset allocation services to institutions. Within these one-pagers, we discuss our findings into both manager research and asset allocation. To subscribe to these one-pagers, please sign-up here. Professional investors only please.