ESG Services

At Fundhouse we take Environmental, Social and Corporate Governance (ESG) standards seriously and see them as being integral to our firm mission of doing the right thing for end savers, our clients and the industry.

We help our clients stay ahead of the curve in the quickly evolving world of ESG and deliver clear and meaningful ESG outcomes to their stakeholders. Although we evaluate specific ESG strategies, we are conscious that ESG remains a minor area of specialisation for many fund groups. And because we aim to see ESG become mainstream, we focus most of our attention on the ESG credentials of all funds or portfolios we evaluate, not just the ESG-specific ones.

Our Approach to ESG

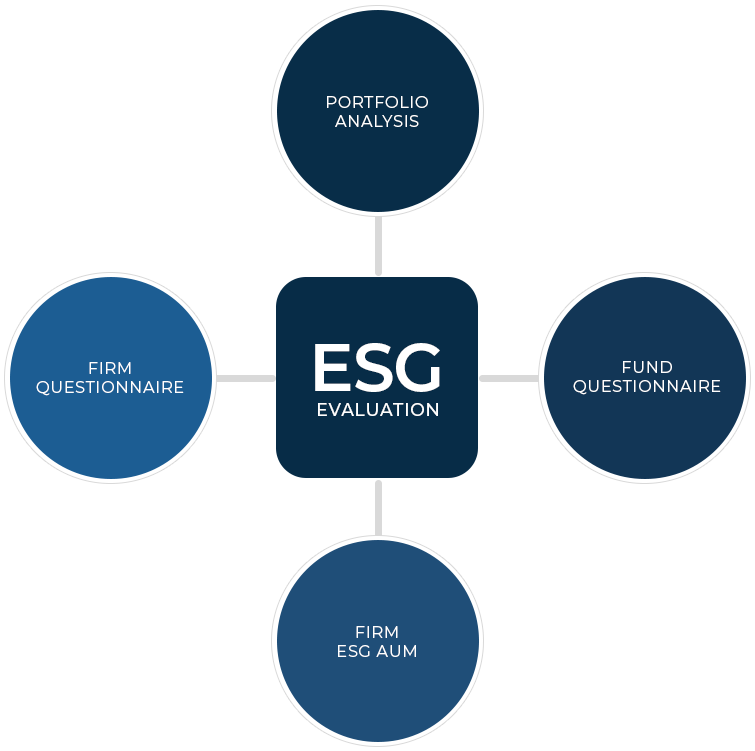

Our process includes firm- and fund-level ESG analysis. Our firm-level questionnaire focuses on the asset manager’s ESG policies, governance, leadership in the industry, engagement with firms/governments and how much capital is allocated to ESG type strategies.

The fund-level questionnaire focuses on the fund manager and his/her integration of ESG into their strategy (negative, positive screening, impact investing etc). The Fundhouse team is able to tailor the process to our clients’ needs based on their specific sustainable and ethical criteria. We can also offer clients and prospects a standalone ESG assessment of their fund range. Below we show our ESG process, noting that this forms part of our overall manager research process.