Manager Research

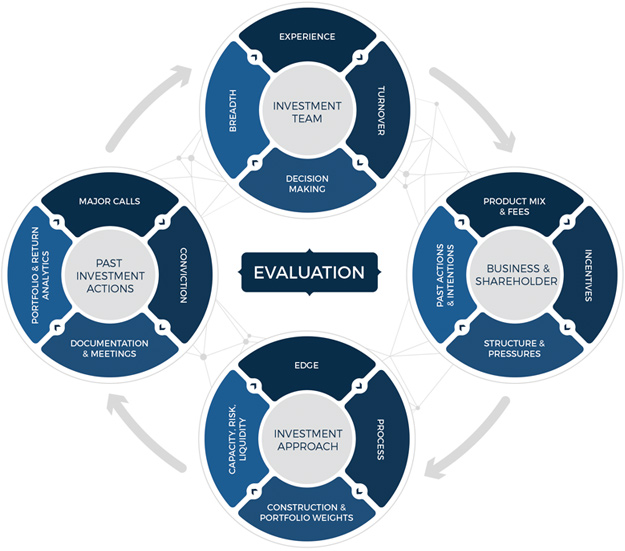

Below, we show our 16-factor process that acts as a long-standing guide to analysts.

How We Evaluate Fund Managers

- We have a comprehensive track record tracking each rating

- Negative ratings save clients from poor funds

- We have a pioneering approach to using data to assess managers

- Often ex investors are involved in interviewing managers

- Each rating is peer-reviewed

- We leave no stone unturned

Why Fundhouse?

About Manager Research Ratings

- Tier Rating One

This is our top rating. We are satisfied that this offering is managed according to a well-considered process which is applied consistently and supported by the business, that we believe is likely to add value over time.

- Tier Rating Two

- Tier Rating Three

This is a negatively rated strategy. We have one or more fundamental concerns about aspects of this strategy and believe there are better alternatives. We also believe the odds of this strategy adding value are low.

How We Select Funds to Rate

Our research is largely client driven, based on their needs, but we conduct an ongoing market assessment to see if there are additional investment strategies which we need to cover.

If you are a fund manager, please click here to see how best to interact with us

Currently we cover:

- Funds and separate accounts

- Onshore and offshore funds

- Open-ended and closed-ended strategies

- Single-asset class and multi-asset class strategies

- Alternatives

- Active and passives

- Strategies from large institutions as well as smaller boutiques

The Rating Process

We cover each investment strategy comprehensively by following the steps below

- Information Gathering

- Fund Manager Visit

- Rating Meeting

- Peer Review

- Review Process

- Fund Manager Feedback